I am free, and I can do what I like when I like. I could, if I chose, travel this continent going where I like when I like.

I could . . . not forever, but at least until my savings ran out.

This is because I am debt free. I got debt free by living in a trailer to save on living expenses and then using that extra cash to pay down my debt until it was paid off.

That is something special, and something that I am used to. So, returning to being indebted is not something I have any desire to do (such as get a mortgage).

People look at me as crazy and just “not normal” for not being in debt and my aversion to it.

Yet I look at people who are buried in debt with no hope of ever becoming debt free as the crazy ones, yet they are certainly “normal” and that is terrifying.

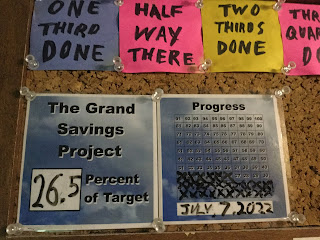

Back to me and my savings and my trailer. I am still here, even after paying off all of my debts so that I can build up enough savings in order to get a home, land and a bit of savings left over, all while remaining totally debt free.

So, I will find a way to endure 5 or 6 more years (the latest date I am kicking around is my 55th birthday, but we shall see if my patience holds out that long.

So, while I am free, by being debt free, I am working to be freer, by having a little place that is mine.

As always: Keep your head up, your attitude positive, and keep moving forward.